child tax credit 2022 schedule

In 14 million dollar house maine. Child Tax Credit Payment Schedule 2022.

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

After you call enter.

. In response to its decision to ban abortion access in the state Georgia will now let taxpayers claim their unborn fetuses as dependents on their tax returns. 2021 Child Tax Credit Basics These FAQs were. The advanced payments of the credit will continue in 2022 as.

Child tax credits of up to 3600 per child and the earned income tax credit worth up to. In New York last fall Gov. Andrew Cuomo signed one of the nations most restrictive laws penalizing Airbnb.

Child Tax Credit Payment. Individual Income Tax Return and attaching a completed Schedule 8812. The amount of the credit is smaller and eligibility is.

Posted editable nfl playoff bracket 2022. The CUAC is a tool to provide an estimate of what tenants will pay for utilities and is typically more accurate than a public housing authority PHA utility allowance schedule. 1 day agoLive TV Schedule.

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 US. 2022 Income Limits for Projects Placed in Service from 362015 3312021. Call the EBT Customer Service number 1-877-328-9677 on the back of your card.

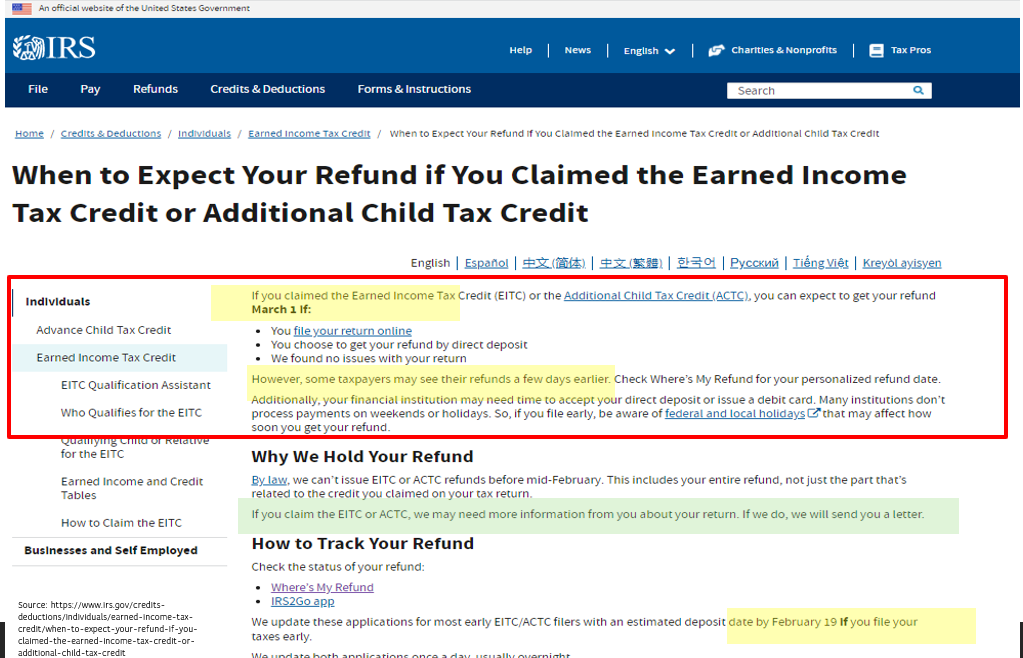

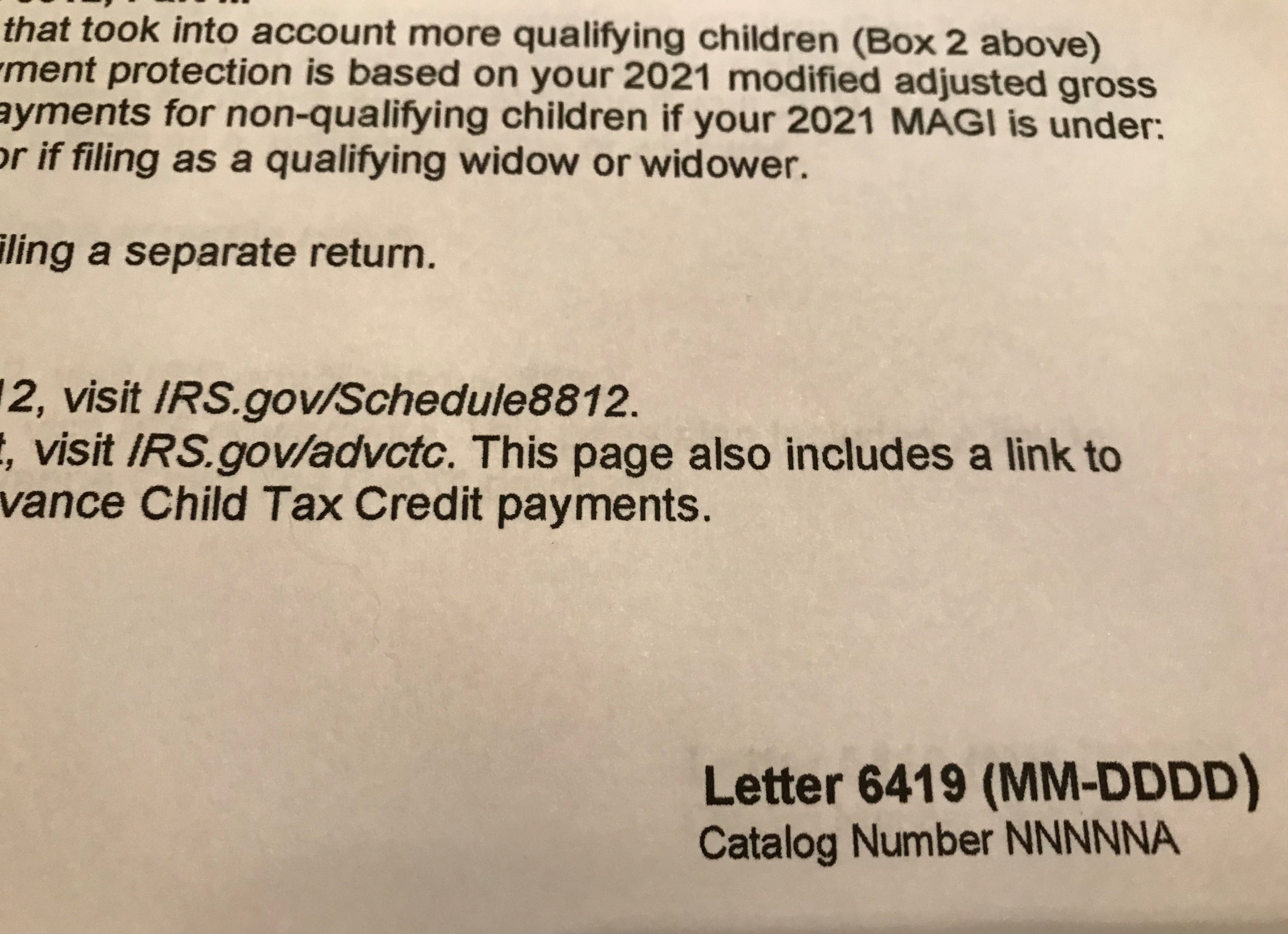

A payment of tax credits for the tax year 2022 to 2023. Oct 17 2022 142 PM EDT Updated Mon. If youre received advanced child tax credit payments at any time during 2021 fill out Schedule 8812 and attach it to your return.

The calculation of the child tax credit in 2023 will be different than in previous yearsAs inflation increases the credit amount will decrease. 2022 Income Limits for Projects Placed in Service from 1109 352015. Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022 February 18 2022 March 18 2022 April 20 2022 May 20.

This was calculated using the Supplemental Poverty Measure which. For past tax rates and taxable wage limits refer to Tax Rates Wage Limits and Value of Meals and Lodging DE 3395 PDF or Historical Information. The child tax credit has been the biggest helper to taxpayers with qualifying children under 18.

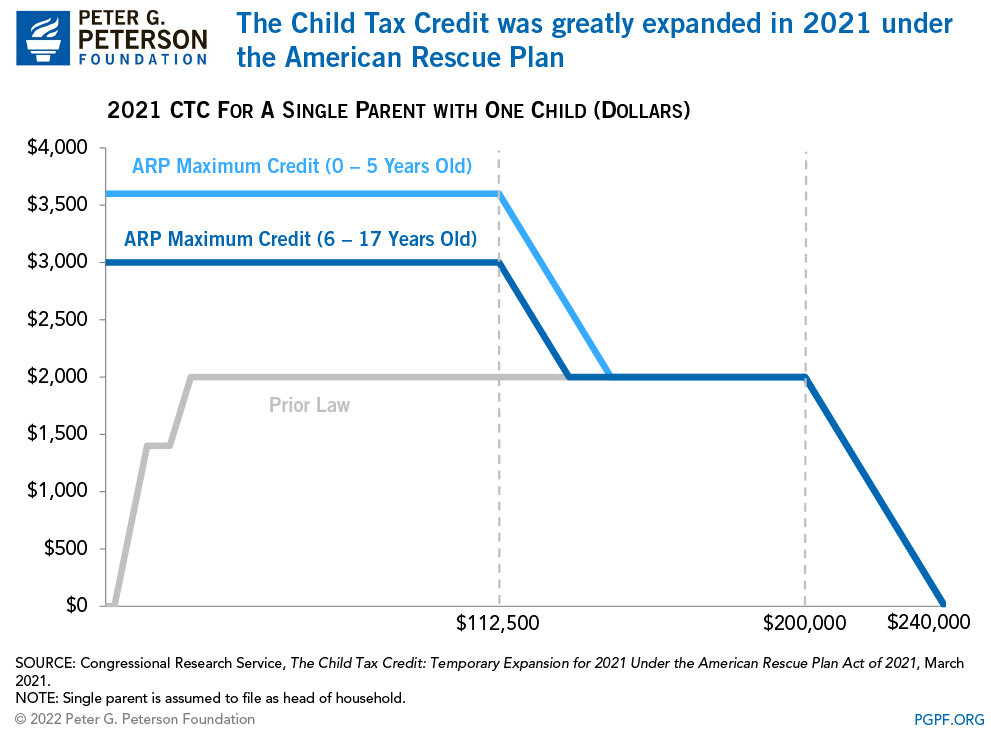

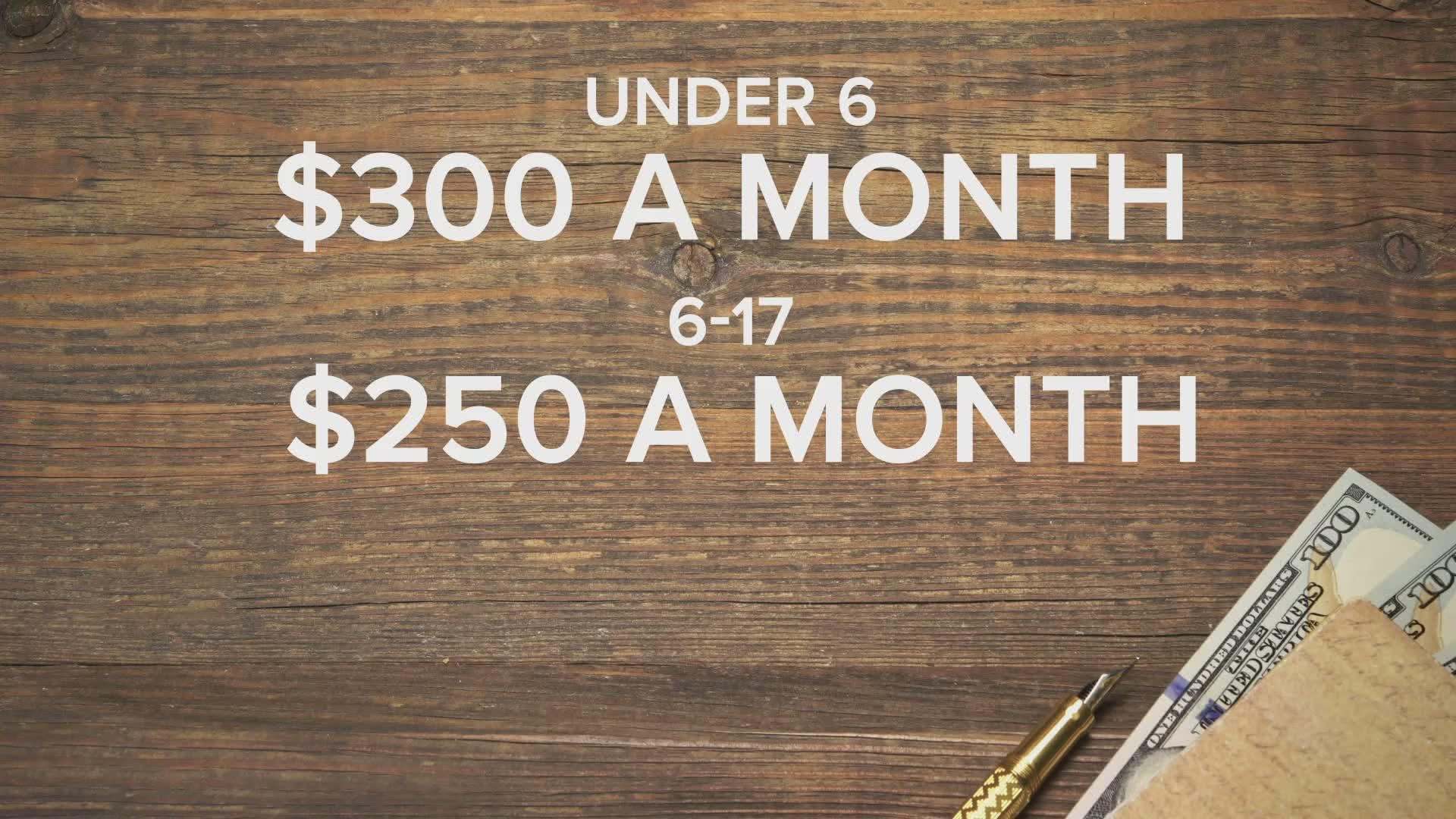

The Customer Service Hotline is available 24 hours a day 7 days a week. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Census Bureau data released on September 13 the US child poverty declined 46 from 97 in 2020 to 52 in 2021.

As of now the child tax credit is worth 2000 per. You must report the monthly payments. 26th Sep 2022 0900 Child Tax Credit overall decreased poverty According to US.

Individuals Child Tax Credit Tax Year 2021Filing Season 2022 Child Tax Credit Frequently Asked Questions Topic A. Why file Schedule 8812.

Child Tax Credit 2022 What We Know So Far

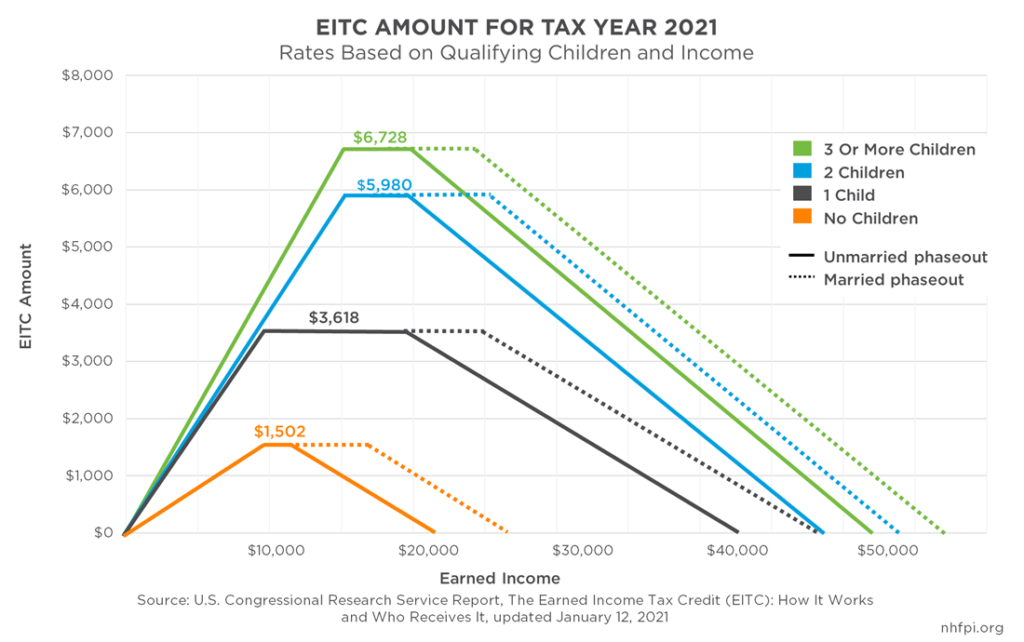

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute

New Jersey Child Tax Credit Eligibility Amount And Income Limits Marca

Path Irs Refund Payment Dates And Processing Delays For Tax Returns With Eic And Actc Payments Latest News And Updates Aving To Invest

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

/do0bihdskp9dy.cloudfront.net/02-01-2022/t_b29bf212b10f46eb833712837080bb76_name_file_1280x720_2000_v3_1_.jpg)

Child Tax Credit Payments What S Next

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Child Tax Credit Payment Schedule Here S When To Expect Checks 10tv Com

Child Tax Credit Payments What S Next

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2022 Payments Of 750 Available For Americans See If You Have The Qualifications To Apply The Us Sun

What The New Child Tax Credit Could Mean For You Now And For Your 2021 Taxes Newswire

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

T21 0226 Tax Benefit Of The Child Tax Credit Ctc Extend Arp Provisions But Retain Current Law Partial Refundability By Expanded Cash Income Level 2022 Tax Policy Center

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com